Users

Projects

Countries engaged

Languages

SOURCE is the multilateral platform for sustainable infrastructure led and funded by Multilateral Development Banks (MDBs) designed to support the:

1. development of projects to bridge the infrastructure gap

2. digitalisation agenda of governments globally; and

3. mobilisation of private finance

SOURCE is the online infrastructure project development software, under UN servers, designed for both traditional procurement and Public Private Partnerships (PPPs) providing:

SOURCE uniquely offers a common framework, incorporating international best practices and private sector requirements, fully adaptable to each country’s processes and interoperable with complementary IT systems; strengthening the capacity of project developers to package sustainable infrastructure projects.

SOURCEs common framework is therefore key to reaching financial close and fulfilling the SDGs, by facilitating an early identification, evaluation and allocation of the projects risks and impacts while enabling the monitoring of KPIs during implementation. SOURCE is freely accessible for emerging countries with the objective to strengthen the capacity of project developers.

SOURCE is easily accessible by any web browser including the following functionalities:

-

-

- Project team management in a secured collaborative environment

- Customisable project timeline according to the country framework and task management system

- Portfolio and Project monitoring dashboards

- Consistency checks on project documentation

- Project Preparation Facilities Finder

- PPP Risk allocation matrix functionality

- Project assessment module enabling to easily evaluate project documentation against national and international methodologies (i.e. FAST-Infra, UNECE PIERS, ADB GRIS)

- SDGs Dashboard

- Knowledge management system to easily store internal best practices

- API connection to existing e-procurement and IT systems

- Document management system

- A public pipeline for international project promotion

-

SOURCE standardised project development templates in line with the following international standards and recognised knowledge products:

-

-

- APMG PPP Guide’s approach (CP3P certification scheme);

- Equator Principles;

- G20 Quality Infrastructure Investment Indicators;

- GIH PPP risk allocation matrix;

- IADB’s Sustainable Infrastructure Criteria;

- IFC Performance Standards;

- ILO’s Decent Work Agenda;

- IMF-World Bank’s PPP Fiscal Risk Assessment Model (PFRAM)

- OECD Principles for Public Governance of Public-Private Partnerships;

- Paris Agreement (Nationally Determined Contributions);

- UNCITRAL Legislative Guide on Public-Private Partnerships;

- UNEP FI Positive Finance;

- UN’s Sustainable Development Goals;

- World Bank’s Guidance on PPP Contractual Provisions;

- World Bank’s Policy Guidelines for Managing Unsolicited Proposals in Infrastructure Projects;

- World Bank’s PPPI Database and benchmarking reports.

-

The strong involvement of the private sector (Supporting partners) to develop the SOURCE project development templates, provide a “common language”. More than 7,000 comments were provided by :

SOURCE is hosted by the United Nations International Computing Centre (UNICC) and aligned with regulations related to data protection and sovereignty of most countries.

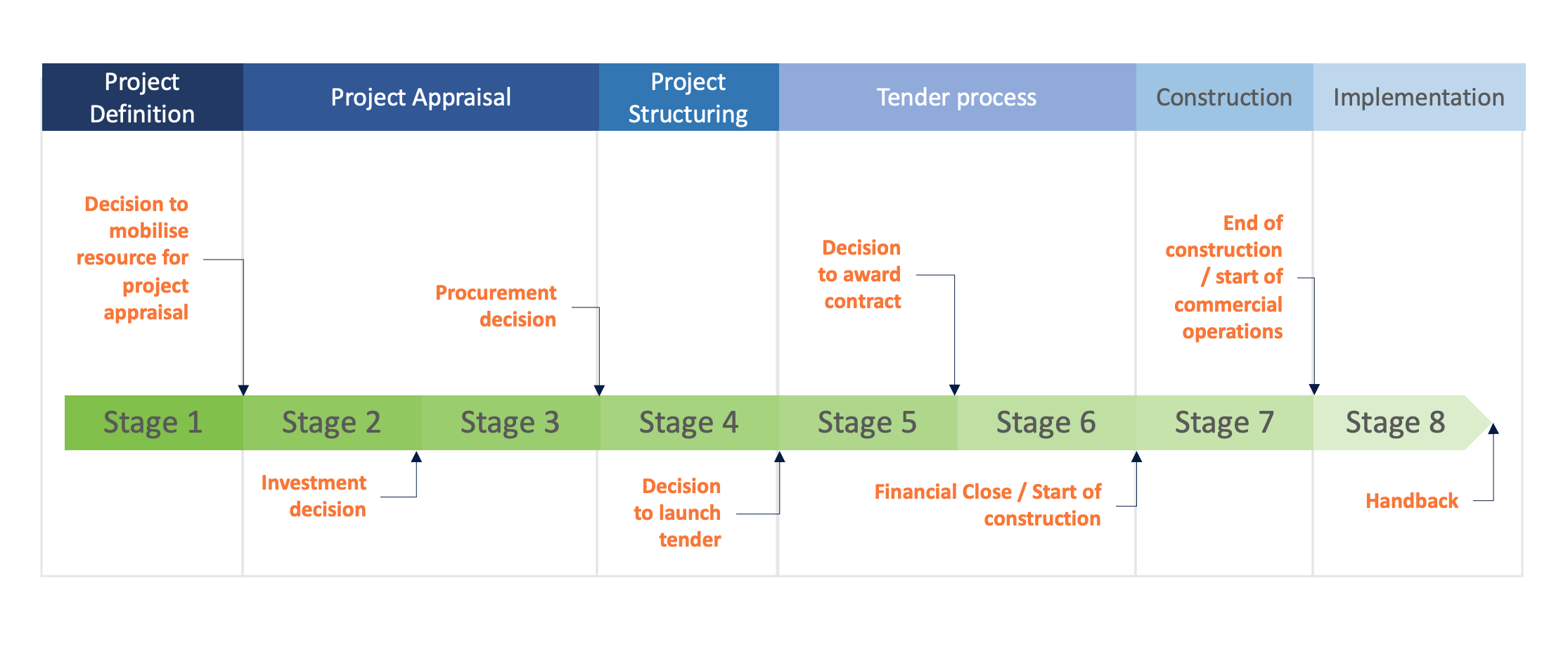

SOURCE covers the entire project lifecycle:

Integration Enquiry

If you are a government/ public agency representative and wish to integrate SOURCE in your country, please contact us:

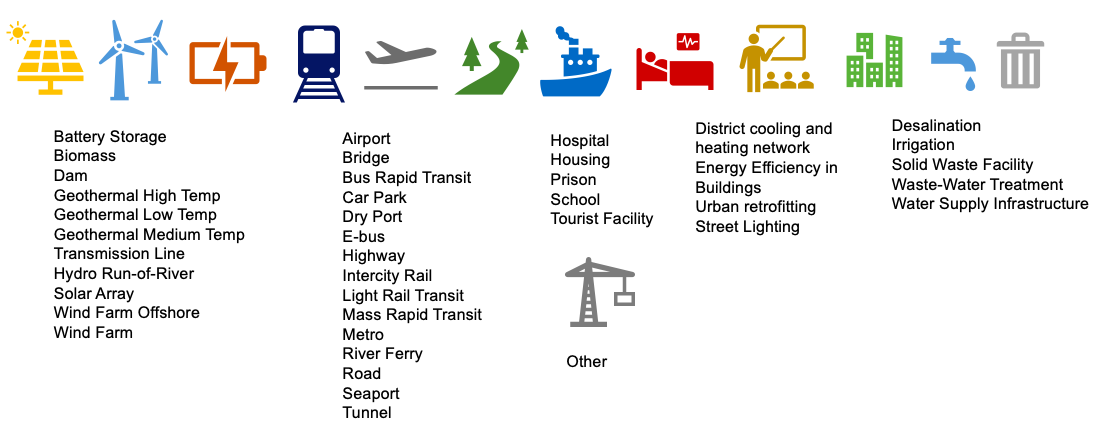

SOURCE covers the full range of infrastructure sectors:

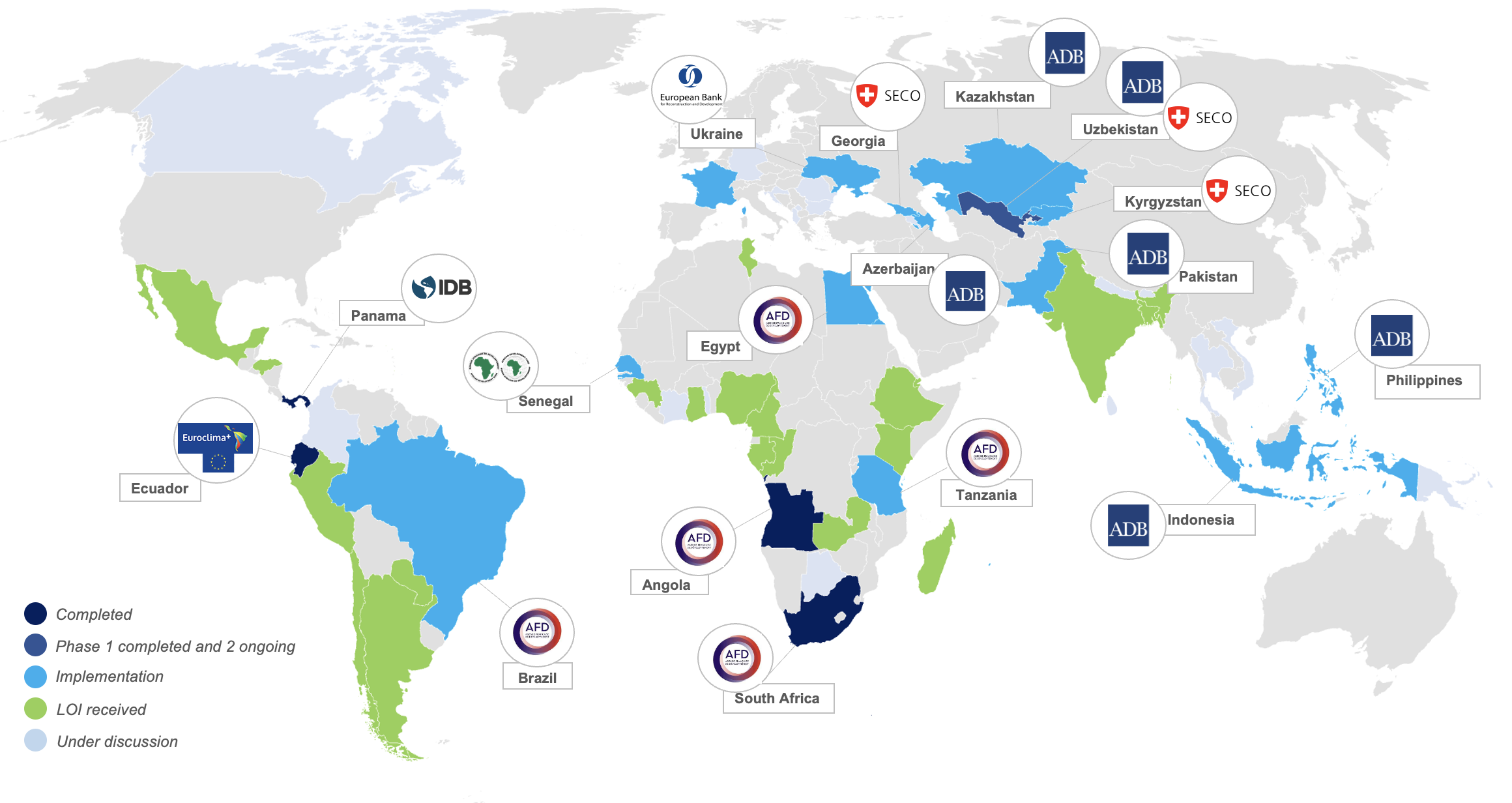

SOURCE global outreach: